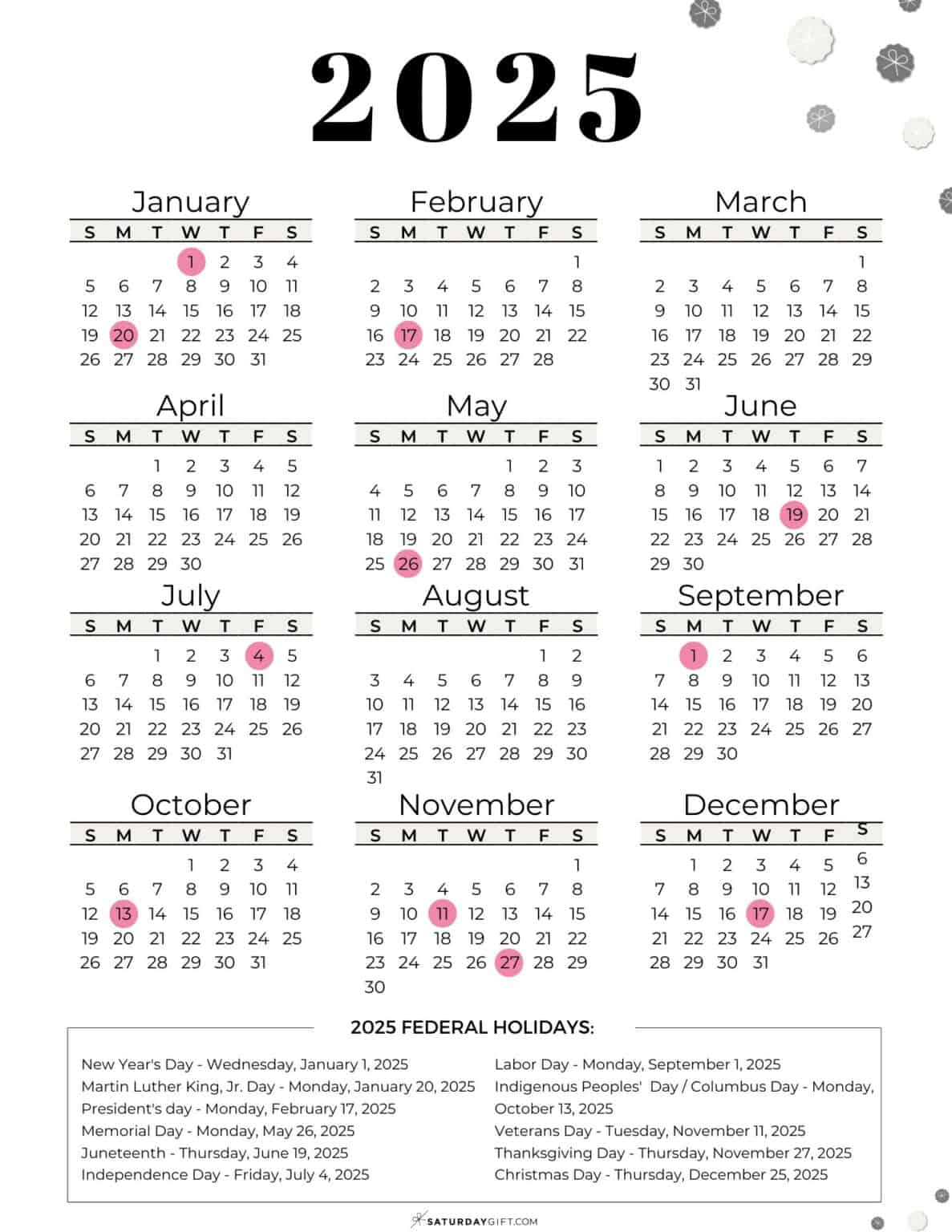

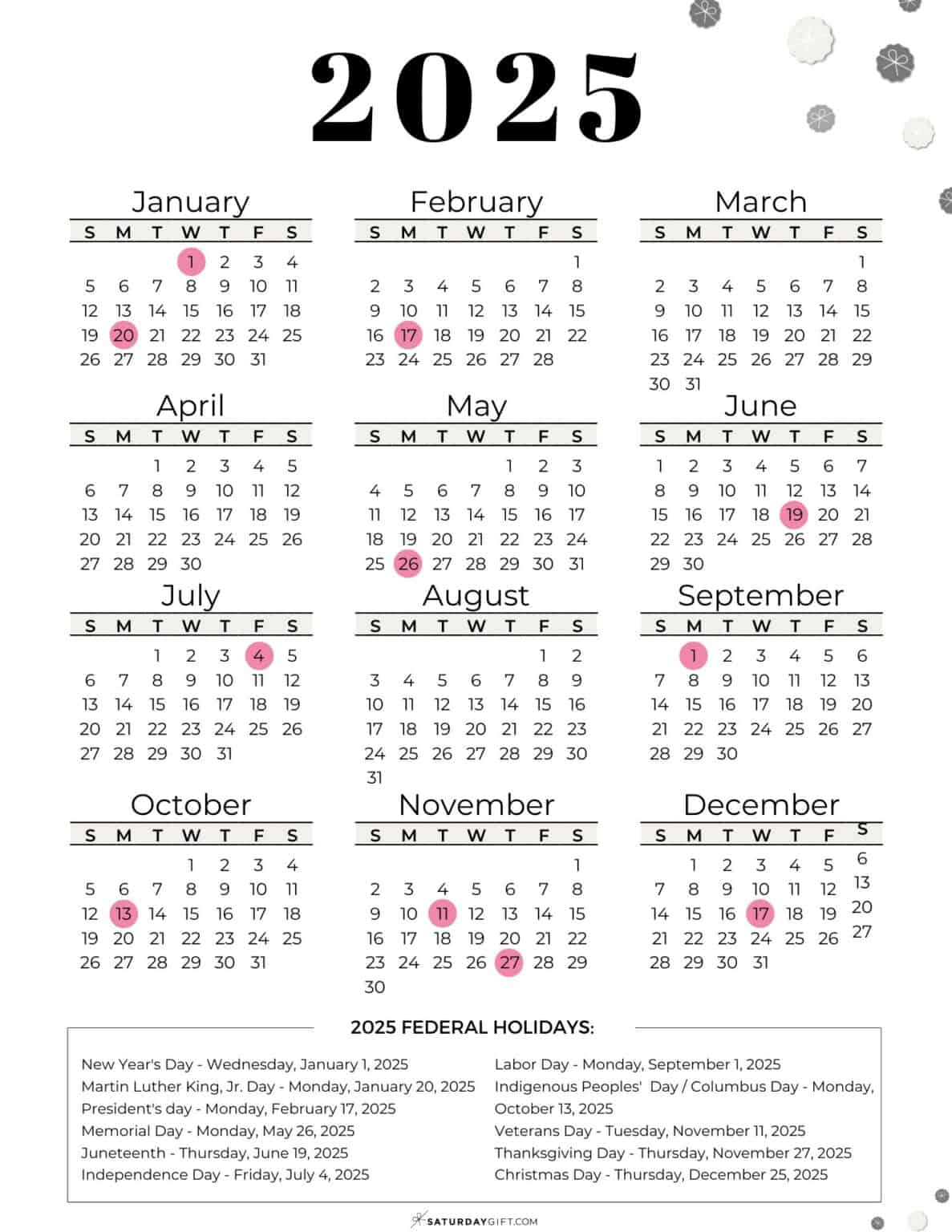

Stay organized with a detailed holiday monthly calendar. View all the national and international holidays month by month, helping you plan vacations and special events easily.

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the IRS Refund Calendar: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

The Internal Revenue Service (IRS) refund calendar, though not a concrete schedule, provides valuable insight into the general timeframe for receiving tax refunds. Understanding this calendar can help taxpayers anticipate the arrival of their refund and manage their financial planning accordingly.

The IRS refund calendar is not a fixed schedule with specific dates for each individual taxpayer. It is a general estimate based on the volume of tax returns processed and the efficiency of the IRS system. Several factors influence the processing time, including:

While the IRS refund calendar does not offer specific dates, it provides a general estimate of processing times based on historical data. Generally, taxpayers who file electronically and have simple tax returns can expect to receive their refunds within 21 days of filing. However, this timeframe can vary depending on the factors mentioned above.

The IRS refund calendar can be a useful tool for financial planning. By understanding the general timeframe for refund processing, taxpayers can:

The IRS does not publish a specific refund calendar with exact dates. However, the IRS website provides valuable information regarding tax refund processing times and related resources. You can access this information on the IRS website: [Insert Link to IRS Website].

You can track the status of your tax refund using the IRS’s "Where’s My Refund?" tool available on the IRS website. This tool allows you to check the status of your refund using your Social Security number, filing status, and the exact amount of the refund claimed on your tax return.

While there is no guaranteed way to expedite the processing of your tax refund, you can take the following steps to ensure a smooth and timely process:

If you owe the IRS taxes, you will receive a notice indicating the amount owed and the due date for payment. You can pay your taxes online, by phone, or by mail. Failure to pay taxes by the due date can result in penalties and interest charges.

The IRS refund calendar is a valuable resource for taxpayers, providing general estimates for processing times and enabling informed financial planning. By understanding the factors influencing refund processing and utilizing the available resources, taxpayers can navigate the refund process efficiently and manage their finances effectively. Remember, accuracy, completeness, and timely filing are crucial for receiving your tax refund promptly.

Thus, we hope this article has provided valuable insights into Navigating the IRS Refund Calendar: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!

Your email address will not be published.